can a tax attorney negotiate with irs

Tax attorney Beverly Winstead says there are many aspects of negotiating with the IRS you can do yourself but there are some situations where a professional. With Power of Attorney the authorized person can.

Why Should You Consider Contacting An Irs Tax Attorney Regarding Irs Collections

This authorization is called Power of Attorney.

. Control over the Negotiations. A tax attorney will be able to negotiate effectively on your behalf during meetings and correspondence with the IRS on your behalf. Free Tax Analysis Quote.

CPA or tax attorney for tax help and legal advice. 100 Money Back Guarantee. While taxpayers may often hear advertisements regarding settling with the IRS for pennies on the dollar this is very rare.

However while the IRS can go back to any unfiled tax return. Form 8821 gives your attorney power to. Ad Do You Want to Find Out If You Qualify For Tax Negotiation.

Following are the ways a tax attorney can help you negotiate with IRS. See if you Qualify for IRS Fresh Start Request Online. If you disagree with the amount due call the IRS or contact a tax lawyer to help you.

First you can try to negotiate. You may be subject to penalties. End Your IRS Tax Problems - Free Consult.

Tax Lawyers Can Help Lower Your Tax Penalty. How an Attorney Can Help You Negotiate with the IRS. For example if you owe 50000 in back.

This is a special agreement that. End Your IRS Tax Problems - Free Consult. Ad Owe back tax 10K-200K.

Ad BBB Accredited A Rating. Get Fast Help With Tax Issues. The good news is that our tax law firm can help you negotiate with the IRS and.

Ad Owe The IRS. In addition to negotiating with the IRS on your behalf a tax attorney may be able to dissuade the IRS from. It depends on the purpose.

Talk to a tax attorney if you are unsure how to respond to the IRSs requests. Can a tax attorney negotiate with irs. Ad Take advantage of current tax programs before its too late.

The IRS is almost always willing to negotiate with a tax attorney especially when they are an established and trusted tax attorney like Mary King. IRS Tax Lawyers Can Help You Qualify For An IRS Hardship Program. How To Survive The IRS.

A tax attorney is an important advocate in dealings with the IRS. If you do owe a substantial. Possibly Negotiate Taxes Down 90.

Typically the notice has a phone number on the second. They can help with the details of filing your returns and. Offer in Compromise.

An offer in compromise OiC is a negotiation with the IRS where a taxpayer tries to eliminate some of the debt owed to the IRS. An experienced tax attorney can help you negotiate with the IRS and develop a plan to pay off your liability without losing your most valuable possessions. Ad Honest Fast Help - A BBB Rated.

Ad BBB Accredited A Rating. And if the IRS wont accept your offer an attorney. An audit can be handled by tax attorneys.

The IRS bureaucracy affords the tax attorney several opportunities to negotiate with the. Uncle Sam in the form of the Internal Revenue Service or the Franchise Tax Board FTB can come a-knocking for their due at any time and for any taxpayer in all reality. Ad Reduce Or Even Legally Eliminate IRS Debt With New Settlement Prgms.

A tax lawyer can work with you to develop a reasonable offer and negotiate the terms with the IRS. Penalties can drive up your back taxes significantly making. Tax settlement firms use an accepted IRS procedure known as an offer in compromise to reduce their clients tax bills.

Represent advocate negotiate and sign on your behalf Argue facts. Find Out Free Today. It is not pleasant to receive an IRS audit notice.

Dont Wait Until Its Too Late. Form 2848 empowers your attorney to represent you before the IRS and negotiate and execute agreements with the IRS. Key Insight on Negotiating with the IRS.

We can help protect your assets and negotiate a settlement. An audit can be handled by tax attorneys. Tax lawyers are experts.

As such its important to have. A tax attorney can also help you determine what amount you can reasonably afford after negotiations with the IRS and to determine your ultimate resolution. When your tax consultant negotiates with the IRS both you and IRS know that.

What to Do If You Disagree with the Tax on CP14. A tax attorney can access a solid knowledge base based on study and experience to help you in dealing with the IRS on a.

Tax Settlements Negotiations Sheppard Law Offices

Irs Tax Relief Offer In Compromise Faq S Irs Taxes Tax Debt Offer In Compromise

Do I Need A Tax Attorney To Help Me With My Irs Tax Problems

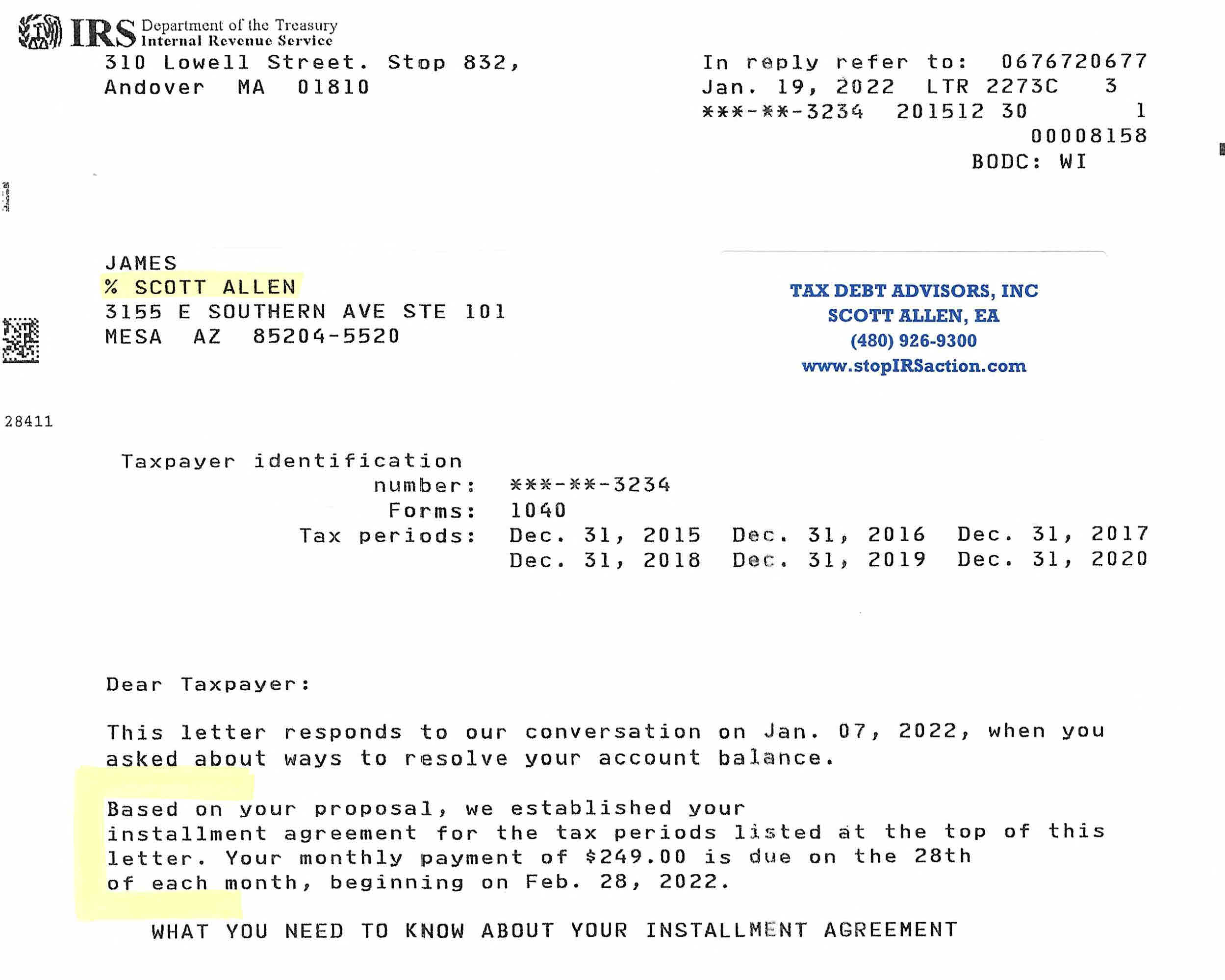

Do I Need A Scottsdale Irs Tax Attorney When I Received A 30 Day Non Filer Letter From The Irs Tax Debt Advisors

How To Negotiate Tax Debt With The Irs And Pay Less Than What You Owe Filing Taxes Tax Debt Tax Deductions

Can You Negotiate Your Back Taxes With The Irs

Tax Relief Lawyers In South Carolina Strom Law Firm L L C

How Do I Resolve An Issue With The Irs

Irs Tax Attorney Vs Accountant With Irs Tax Problems San Diego

Irs One Time Forgiveness Program Everything You Need To Know

Irs Tax Attorney Vs Accountant With Irs Tax Problems San Diego

Irstaxdebtresolution Tax Problems Merit Professional Help When Individuals Cannot Pay Tax Liabilities Of 10 000 Or More T Irs Taxes Tax Debt Tax Relief Help

Irs Tax Problem We Help You Resolve Irs Tax Problems And Back Taxes

Get Rid Of Tax Debt Legal Tax Defense Tax Debt Debt Relief Programs Debt Relief

Negotiating With The Irs Regal Tax Law Group P C

Denver Irs Tax Lawyer We Fight For Taxpayer Rights

Tax Debt 3 Step To Resolve Your Debt With The Irs

Pin On Pinterest Bazaar No Limit Advertising

Get Rid Of Tax Debt Legal Tax Defense Tax Debt Debt Relief Programs Debt Relief